Read our most recent market updates below!

A Look at 2024/25 Supply & Demand Prospects

Seeding plans are mostly set in stone by this time of year, however there are still varying ideas of what Canadian seeded area in 2024 will look like. StatsCan gave their first look at 2024 seeding intentions in mid-March but that’s far from the final word. The StatsCan survey was conducted from mid-December to mid-January and since then, both feed and malt barley prices have declined. Malt prices have dropped from above $7.00/bu to just below $6.00/bu on average across Western Canada. Feed values have seen a similar slump, falling from $5.45/bu to lows $4.75/bu on average in March.

The lower prices combined with poor movement have cast a shadow on the barley market and we’re hearing that farmers may opt for other cereals or pulses where they can. This could mean that barley has lost acres since the StatsCan survey. Because of this uncertainty, we like to compare a few estimates of barley acreage to see how they could affect the outlook for 2024/25.

The range of estimates (that we’ve seen) of 2023 barley acreage ranges from a low end of 6.6 mln to the high end at 7.5 mln acres. For reference, seeded area was 7.3 mln acres in 2022 and over the past five years, has ranged from 6.5 to 8.3 mln acres. StatsCan’s estimate was mid-range at 7.1 mln acres, while we anticipate acres closer to the lower end.

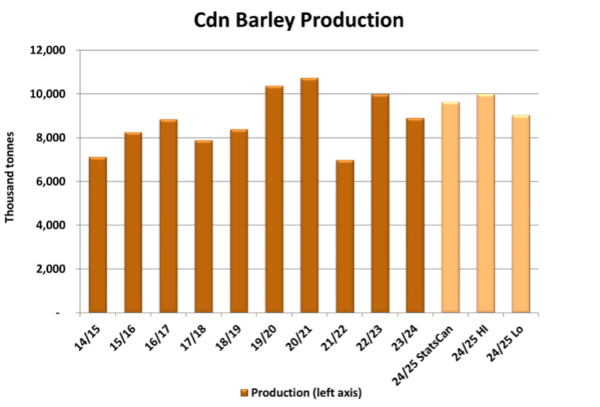

At this very early stage of the year before the crop is in the ground, the best odds for a yield guess is somewhere close to average. We are using an “olympic” average (the last five years after dropping the high and the low) of 67.5 bu/acre, up from 61.3 bu/acre in 2023. The result would be a 2024 barley crop ranging from 9 mln tonnes to 10 mln tonnes, above the 8.9 mln tonne crop in 2022/23, but in the vicinity of the 5-year average of 9.4 mln tonnes.

There is still some uncertainty over 2023/24 ending stocks, although a larger-than-average carryover is likely, given the reduced export pace and slow domestic feeding this season. As a result, total 2024/25 barley supplies could actually be larger than the current year, with projections ranging from 10.7 mln tonnes on the low-end to 11.7 mln tonnes on the high-end. This is well above the 2023/24 supplies at 9.65 mln tonnes, and the 5-year average of 10.3 mln. The heavier supplies will weigh on the barley outlook in 2024/25.

Domestic feed use is the largest part of Canadian barley usage. Barley’s share of that market can vary due to availability of other feedgrains like feed wheat and corn. So far in 2023/24, the Canadian barley market has faced weaker domestic demand as increased imports of US corn have displaced barley feeding. Other domestic usage includes malting, which has been stagnant in recent years. Looking ahead to 2024/25, we anticipate US corn imports into western Canada to continue (barring any major production issues), albeit at a slower pace. Domestic usage is projected to improve overall in 2024/25 but remain slightly below the 5-year average.

Even though exports aren’t the largest part of Canadian barley use, volumes can be quite variable ranging from 2.2 to 3.5 mln tonnes over the past five years. China is the dominant destination for Canadian barley, accounting for 80-90% of the total. So far in 2023/24, demand for Canadian barley has been reduced due to increased competition from Australia into the Chinese market, a result of the repaired trade relations and removal of tariffs on Australian barley imports. The outlook for 2024/25 isn’t exactly clear, but we expect to see continued competition from Australia, keeping Canada’s market share into China reduced.

Even with improved demand in 2024/25, ending stocks next year are still projected to be relatively heavy (in all scenarios) due to the larger supplies. Of course, these acreage estimates won’t mean much if yields are a lot different than the average. Dryness is still a real concern in the western prairies. A change of a few bushels per acre can offset acres, either higher or lower.