China Driving Global Barley Markets

It was only a few years ago that Saudi Arabia was the only export market that really mattered for barley. It wasn’t as important for Canada, and even less so since the Saudis banned imports of Canadian in 2018, but it was the world’s largest importer, regularly taking 8-9 mln tonnes of barley per year. It has since faded and dropped to 2.9 mln tonnes in 2020, the last data available.

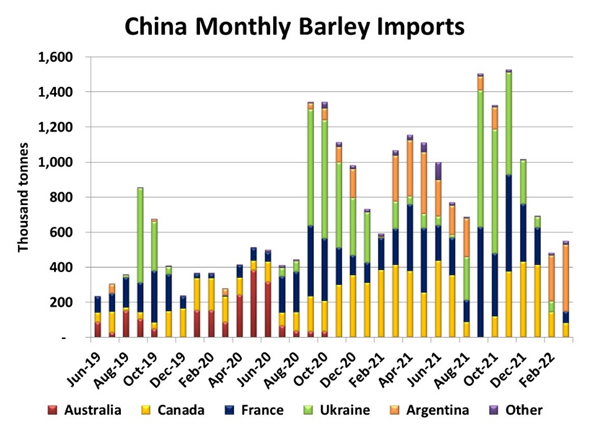

China has now taken over the title of the largest barley importer, and by a wide margin. In 2020/21, China imported 10.8 mln tonnes of barley and 2021/22 is running ahead of that pace, at least so far. Despite these record volumes, politics have also affected Chinese barley imports. A couple of years ago, when China was buying a lot less barley, Australia was a major supplier but has since been shut out due to political irritants.

Since then, Chinese imports have jumped sharply and all sources (other than Australia) have been tapped, including Ukraine, France, Argentina and Canada. The shifts in origins shown in the chart mostly relate to seasonal availability from various countries. For example, in the last few months, imports from Ukraine dropped off as its barley stocks were drawn down; then the same thing happened to France, followed by Canada. Argentina has stepped in lately but still only has limited barley supplies available.

For the next few months, Chinese imports will be minimal as almost no exporters have supplies left. China has been counting on getting access to Ukrainian barley starting in August but now those supplies are in jeopardy.So far, Russia hasn’t been a barley supplier to China due to phytosanitary barriers, but those restrictions have now been eased, which could open the door for more imports of Russian barley. If that happens though, other countries that normally import Russian barley will need to look elsewhere for supplies.

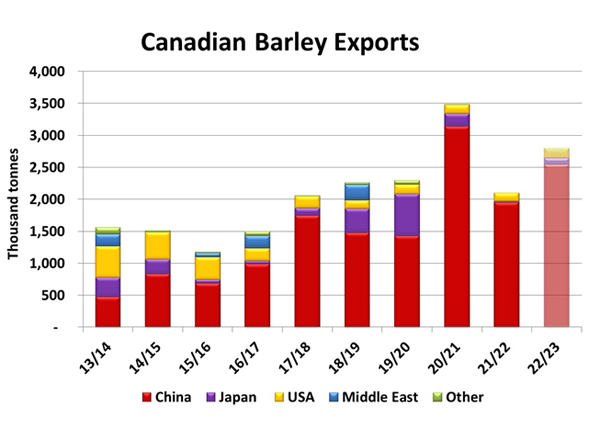

The global supply network is such that threats to Ukrainian barley supplies caused an immediate reaction in western Canada. There was a small blip in old-crop barley prices in western Canada but a much bigger response in new-crop bids for both feed and malt barley. The timing of that move was a strong clue that Chinese buyers were suddenly much more interested in locking up supplies of Canadian barley for fall delivery.

While we hope peace will return to Ukraine, crops get harvested and grain and oilseed shipping can resume, China’s heavy reliance on Canadian barley will have implications for the market in 2022/23. The last two years, China booked large amounts of Canadian barley in spring, well before the crop size was known, which essentially left Canada’s domestic market short of barley by early winter. That was even more noticeable in 2021/22 when drought reduced the Canadian barley crop by roughly 4 million tonnes.

Now, the crisis in Ukraine is setting the stage for a repeat situation, with China booking Canadian barley before planting even starts. If so, large volumes of Canadian barley will be exported this fall, with Canadian feeders scrambling to access supplies through the rest of 2022/23. This also means imports of US corn will be heavy again to backfill western Canadian feed supplies. As long as the drought doesn’t repeat, next year’s situation won’t be as extreme as it is in 2021/22, but the same type of forces will be at work.

For livestock feeders, this means it will be a struggle again to find supplies next year, especially at moderate prices. Meanwhile, growers of barley and feed wheat should see favourable prices again. The most visible evidence of this outlook for strong demand and tight supplies is that new-crop bids for barley at western Canadian elevators have now caught up to old-crop levels.